Are you ready to scale your enterprise?

Explore

What's New In The World of Digital.ai

Escalations Aren’t Noise: They’re Your Most Honest Quality Signal

Most companies insist they care about product quality. Yet many…

Automating QA for Automotive Applications

Whether you’re building a music app, an EV charging service,…

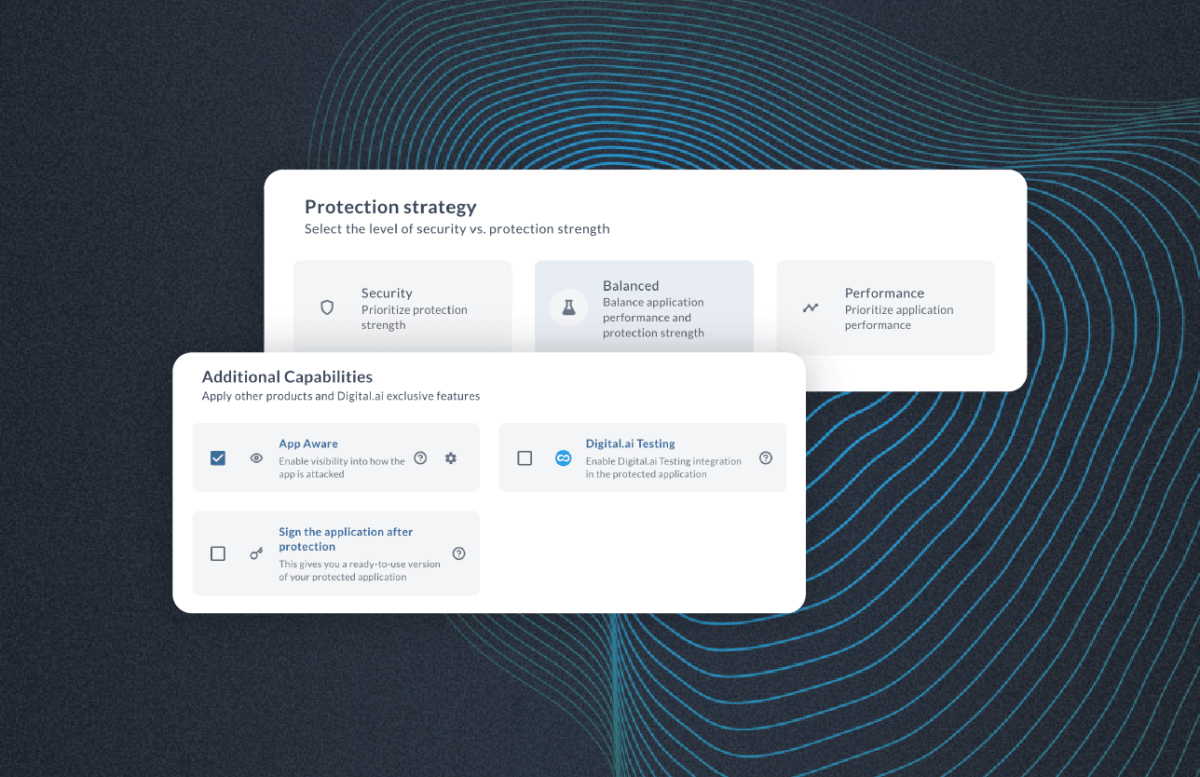

When AI Accelerates Everything, Security Has to Get Smarter

Software delivery has entered a new phase. Since 2022, AI-driven…