Application Hardening for Financial Services

Stop fraud, safeguard customer trust, and meet strict regulatory expectations with application hardening that adapts to the evolving threat landscape across mobile, web, and embedded financial apps.

Banking and Industry are Apps

Exposed to Reverse Engineering

Banking and Industry are Apps Exposed to Reverse Engineering

Attackers dismantle mobile and web apps to uncover logic, secrets, and exploitable flaws.

Tampering Drives Fraud at Scale

Modified or injected code enables fraud schemes, credential theft, and unauthorized transactions.

Fragile Defenses Under Regulatory Scrutiny

Weak app protection jeopardizes compliance with NIST, EMVCo and MPoC, increasing risk during audits and third-party reviews.

Purpose-Built For FinServ

Defense Against Advanced Reverse Engineering

Financial apps are prime targets for attackers who attempt to dissect client-side code to map APIs, hijack logic, or craft automated fraud workflows. Digital.ai provides multilayered obfuscation, anti-debugging, and anti-instrumentation protections that make reverse engineering commercially impractical, even for well-resourced adversaries.

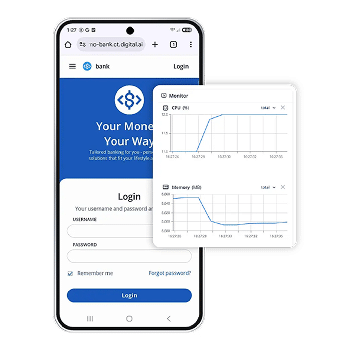

Hardened Runtime Protection Across Devices

Financial institutions cannot control the security state of customer devices. Our runtime protections detect and block jailbreak/root conditions, debugger attachment, hook attempts, and malicious instrumentation in real time. This ensures your app stays trustworthy—even on compromised or hostile endpoints.

Fraud Resistance Built Into the App

Digital.ai Application Security disrupts fraud workflows at their source by preventing tampering, cloning, and automation that criminals use to bypass controls. By securing client-side logic, API pathways, and sensitive keys, we reduce the success rate of credential-stuffing bots, emulator farms, and account manipulation tactics.

Protection That Scales With Your Release Velocity

FinServ teams push updates frequently to meet regulatory, UX, and competitive demands. Digital.ai integrates directly into CI/CD and existing testing pipelines, allowing automatic hardening at build time without slowing releases or requiring code changes—ideal for high-velocity teams and large app portfolios.

Signal You Can Feed Into Your SOC

Digital.ai turns client-side attacks into actionable intelligence. When your app detects tampering, hooking, or suspicious runtime conditions, it sends threat telemetry you can feed into SIEM/SOAR workflows. This strengthens monitoring, supports fraud investigation, and helps teams narrow the gap between attack detection and response.

Customer Success Story

Millions of Dollars

in cost savings

Improved Morale

among SOC staff

The successful defense of our customers’ mobile apps prevented the loss of thousands of customers.

Rodolfo Ramos

Information Security Executive Manager

Benefits of Application Hardening

Reduced Fraud Exposure

Hardens client apps to disrupt automation, tampering, and account-manipulation fraud schemes.

Stronger Regulatory Alignment

Supports requirements around data protection, cryptography, and secure software practices.

Protection on Untrusted Devices

Keeps financial apps secure even on jailbroken, rooted, or compromised customer endpoints.

Secured API Interactions

Safeguards API pathways from mapping, abuse, and unauthorized transaction manipulation.

Higher Customer Trust

Delivers safer mobile banking experiences that strengthen confidence and brand reputation.

Book A Demo

See how we protect your applications from the inside out.

We Are FIPS Validated

NIST FIPS 140-3 is the U.S. and Canadian government standard for validating the security of cryptographic modules. Certification confirms that encryption functions meet rigorous, independently tested requirements. For financial institutions, this validation provides assurance that protected data, keys, and cryptographic operations meet trusted, regulator-recognized security benchmarks.

FIPS 140-3 is technically harmonized with ISO/IEC 19790, which defines international security requirements for cryptographic modules. In other words, FIPS 140-3 is the U.S./Canada adoption of the same core standard that ISO/IEC 19790 specifies globally.

Related Application Security Resources

Why the Automotive Industry Deserves More Focus on Software Quality

For decades, automotive innovation was measured in horsepower, design, and…

What Is In-Car Infotainment Testing — and Why It Matters in the Era of Software-Defined Vehicles

Think about the last time you got into a car,…

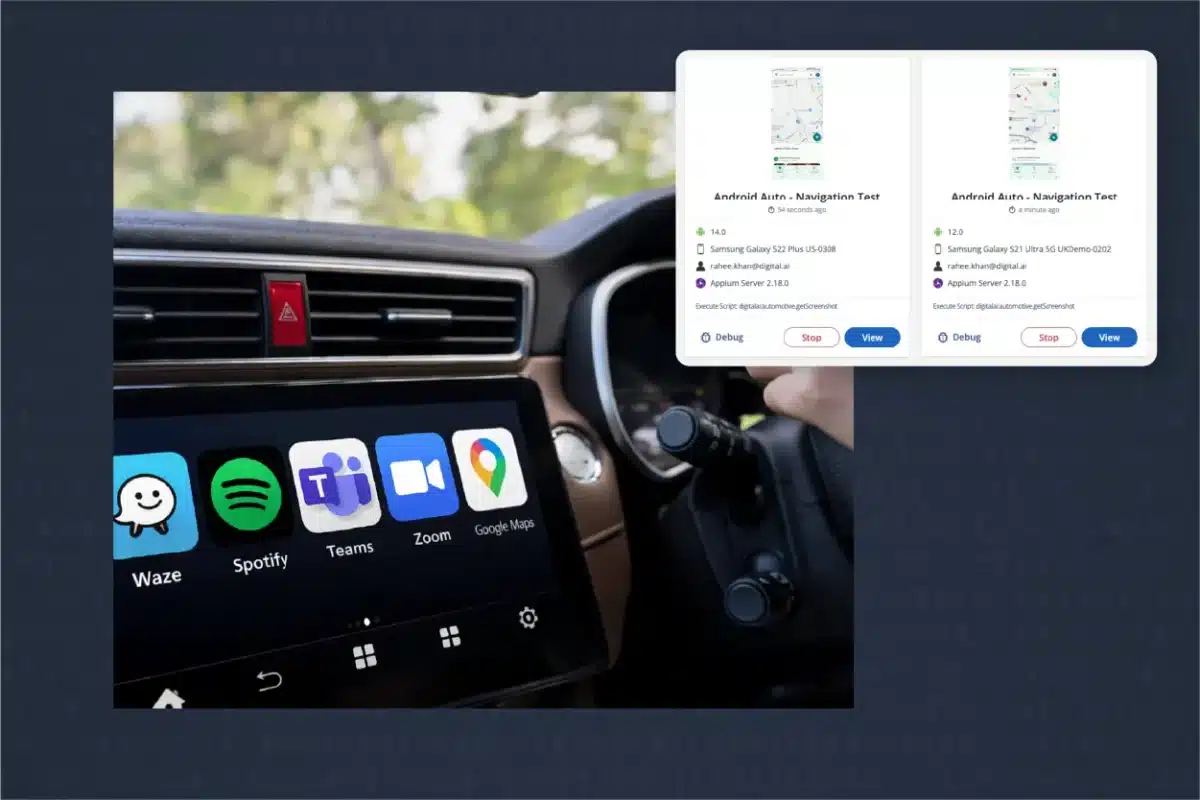

How to Meet Compliance Requirements for Android Auto & Apple CarPlay

The moment a mobile app enters the vehicle environment, it…