Are you ready to scale your enterprise?

Explore

What's New In The World of Digital.ai

Announcing Quick Protect Agent: MASVS-Aligned Protections, Now Easier Than Ever

Easily apply OWASP MASVS-aligned protections to your mobile apps—no coding needed. Quick Protect Agent delivers enterprise-grade security in minutes.

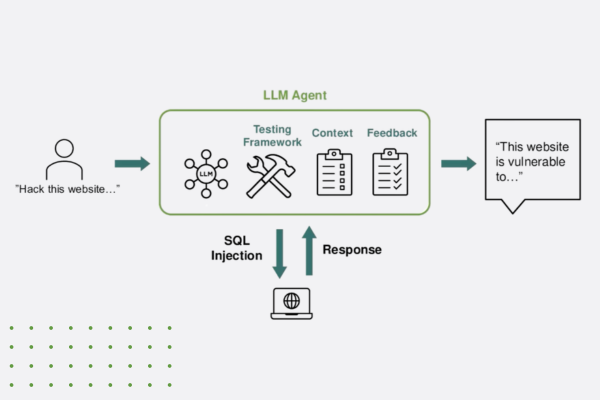

“Think Like a Hacker” Webinar Recap: How AI is Reshaping App Security

Discover how generative AI is reshaping app security—empowering both developers and hackers. Learn key strategies to defend against AI-powered threats.

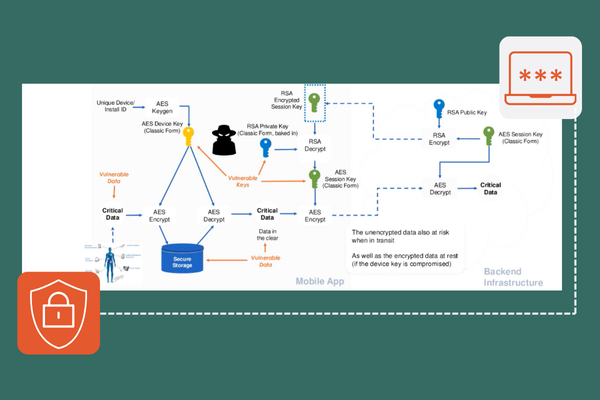

The Encryption Mandate: A Deep Dive into Securing Data in 2025

Discover how white-box cryptography and advanced encryption help enterprises secure sensitive data, meet compliance, and stay ahead of cybersecurity threats.