Catalyst Blog

Featured Post

SEARCH & FILTER

More From The Blog

Search for

Category

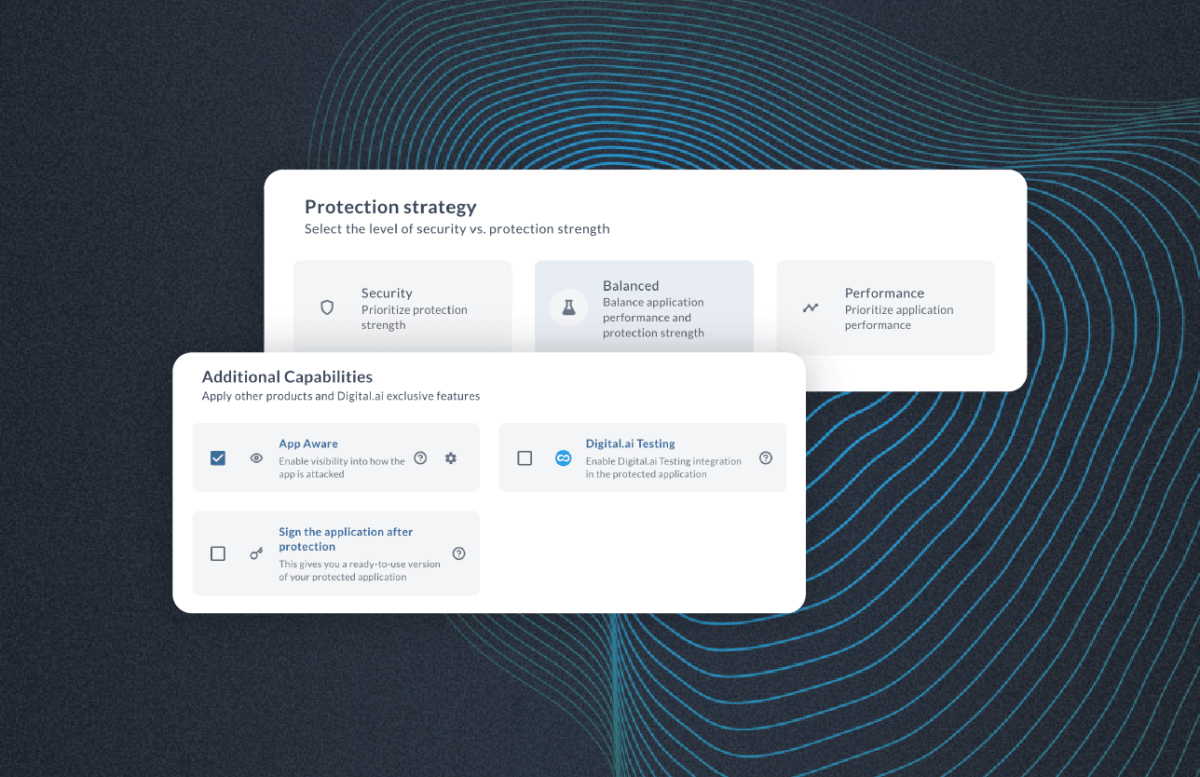

From Defense Labs to Mobile Apps: How Application Protection Grew Up

2001 was a turning point for application security, though few…

Escalations Aren’t Noise: They’re Your Most Honest Quality Signal

Most companies insist they care about product quality. Yet many…

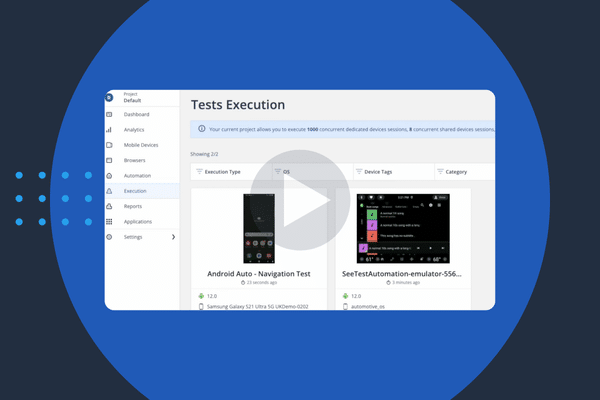

Automating QA for Automotive Applications

Whether you’re building a music app, an EV charging service,…

When AI Accelerates Everything, Security Has to Get Smarter

Software delivery has entered a new phase. Since 2022, AI-driven…

The Invisible Wall: Why Secured Apps Break Test Automation

Modern mobile apps are more protected than ever. And that’s…

Shared, Not Exposed: How Testing Clouds Are Being Redefined

The Evolution of Device Clouds: From Public to Private to…

Evolving Application Security Documentation, One Step at a Time

In 2024, the documentation team at Digital.ai launched a new…